How to Apply for Mortgages in Australia?

How to Apply for Mortgages in Australia, Here’s a breakdown of the steps involved in getting a mortgage in Australia:

Mortgages:

A mortgage is one kind of long-term loan that is exclusively meant to be used to purchase real estate. You borrow money from a lender, typically a bank or credit union, and repay it over a certain length of time—typically 15 to 30 years—repaying the principal, the initial loan amount, plus interest, or the cost to the lender. Since the physical property serves as collateral, the lender is entitled to reclaim it and sell it to recoup their losses if you default on your payments.

Owning Your Slice of the Aussie Dream: Understanding Mortgages in Australia

Australia has a strong homeownership culture, and obtaining a mortgage is the first step towards realizing that culture. Even if the procedure may seem complicated, this article will provide you with a clear grasp of mortgages in Australia, giving you the confidence to go through the process.

How to Apply for Mortgages in Australia?

An Australian mortgage is a type of loan designed specifically to help you purchase a property, offered by banks or other lenders. You borrow the money, often for a duration of 10 to 30 years, and repay the principal—the total amount borrowed—along with interest—the cost to the lender—in equal monthly installments. The actual property acts as security; should payments be in arrears, the lender may take possession of and sell the property to cover its losses.

Types of Mortgages in Australia:

Fixed-Rate vs Variable Rate:

Fixed Rate: Provides consistency in monthly payments by offering a fixed interest rate for a predetermined length of time. This option is well-liked since it is predictable.

Variable Rate: Depending on the state of the market, interest rates can change, which could result in lower starting rates but also a chance of future hikes. This may be appropriate for debtors who are averse to little flexibility or who anticipate an increase in income.

Loan Source:

Major Banks: Offer competitive rates and a variety of loan options.

Smaller Lenders: May provide more personalized service or niche products.

Government-Backed Mortgages: Insured by government agencies, allowing for lower down payments (often 5%) and potentially easier qualification for first-time homebuyers.

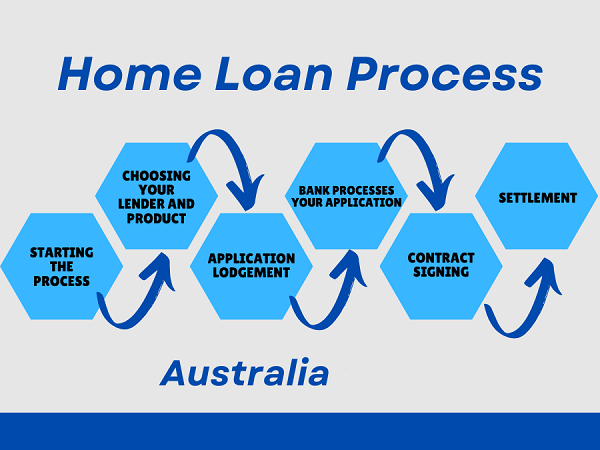

The Mortgage Process in Australia:

A mortgage might be the key to unlocking the door for many individuals who aspire to purchase a portion of Australia. Even though the process seems complicated, don’t worry! By following this tutorial, which will walk you through the Australian mortgage application process step-by-step, you will have the confidence to move forward with the procedure. Kvcore, Best Realtor near me, Find a realtor, Mortgage in Australia

Step 1: Getting Your Financial House in Order

Before diving into the specifics of mortgages, take a good look at your financial situation. Here’s what you need to consider:

Savings: A substantial down payment is necessary. The minimum down payment required in Australia typically ranges from 5% to 20%. Numerous advantages may result from a higher proportion, such as a smaller loan amount, a potentially better interest rate, and a decreased likelihood of mortgage stress.

Debt: A large debt load may reduce your ability to borrow money. Attempt to reduce or pay off current obligations to raise your debt-to-income ratio (DTI), which is a crucial component that lenders take into account.

Credit Score: A high credit score (usually greater than 700) might help you get better loan terms and interest rates by demonstrating that you handle your credit responsibly.

Step 2: Pre-Approval is Your Power Play

Upon gaining an understanding of your financial situation, ask a lender for a pre-approval certificate. Although the amount you can borrow is estimated based on your financial circumstances, this loan is not guaranteed. Here’s why having pre-approval matters:

Realistic Budget: Knowing your borrowing capacity sets a clear budget for house hunting, preventing you from wasting time on properties outside your reach.

Also Read: Kvcore, Best Realtor near me, Find a realtor, Mortgage in Australia

Stronger Offer: A pre-approval demonstrates seriousness to sellers, potentially giving your offer an edge in a competitive market.

Streamlined Process: Pre-approval can expedite the formal mortgage application process later.

Step 3: Explore Your Mortgage Options

The Australian mortgage market offers a variety of loan types to cater to different needs. Here are some key choices to consider:

Fixed-Rate vs Variable Rate:

Fixed Rate: Interest rate remains constant for a set period, offering predictability and stability in monthly repayments. Ideal for those who dislike surprises and prioritize budgeting certainty.

Variable Rate: Interest rate fluctuates based on market conditions. May offer lower initial rates but carries the risk of increases in the future. Suitable for borrowers comfortable with some flexibility and who expect their income to grow.

Loan Source:

Major Banks: Offer competitive rates and a wide range of products, but may have stricter lending criteria.

Smaller Lenders: May provide more personalized services or niche products, but rates might be slightly higher.

Government-Backed Mortgages: Insured by government agencies (e.g., NHFIC), allowing for lower down payments (often 5%) and potentially easier qualification for first-time homebuyers.

Step 4: Partnering with the Right Lender

Do some research and compare the features and costs provided by different lenders. Consider factors such as costs, interest rates, loan conditions, and the quality of customer support. Kvcore, Best Realtor near me, Find a realtor, Mortgage in Australia By negotiating on your behalf and having access to a wider pool of lenders, a mortgage broker can assist you.

Step 5: Formal Mortgage Application

Once you’ve chosen a lender and loan option, it’s time for the formal application. This typically involves submitting a comprehensive set of documents, including:

1. Proof of income (payslips, tax returns)

2. Bank statements

3. Asset verification (ownership documents for investments or property)

4. Employment verification

5. Details of the property you’re purchasing (sale contract, valuation report)

Step 6: Loan Approval & Loan Contract

The lender will carefully review your creditworthiness and application. The underwriting procedure establishes your eligibility for the loan as well as the interest rate that will be provided. You will receive a loan contract with the final terms and conditions upon approval. Before signing, carefully go over and comprehend all of the details.

Step 7: Settlement – The Grand Finale!

Congratulations! You’ve navigated the mortgage process and reached settlement day – the exciting moment you officially become a homeowner!