Student loans in the US

Overview:

Student loans are one kind of financial aid that students use to help cover the cost of their higher education. They could be issued by the federal government, private lenders, or other organizations.

1. Federal Loans for Education:

Federal student loans give many aspiring students financial wings so they can pursue higher education without totally relying on their personal or family finances. Unlike private loans, they are backed by the government, which typically results in lower interest rates and more flexible repayment options. These loans come in two main varieties: subsidized and unsubsidized.

When you take out subsidized loans, the interest is covered by the government during grace periods, deferment periods, and times when you are enrolled at least half-time. Students who have demonstrated a need for financial assistance are eligible for these loans. During this interest-free grace period, students can focus on their studies without accruing more debt. Conversely, regardless of their financial need, all eligible students may apply for unsubsidized loans. But even during grace and deferment periods, these loans start charging interest as soon as they are disbursed.

Despite the many advantages of federal student loans, you should approach them cautiously and with a well-defined plan in mind. Remember that repaying these loans will require you to incur debt, which could have a long-term impact on your finances. To ensure that you can effectively manage your loan burden, consider alternative funding sources like grants and scholarships, thoroughly assess your borrowing needs, and look into different loan payback schedules.

Navigating the world of federal student loans requires meticulous preparation and informed decision-making. By understanding the various loan types, their terms, and your financial situation, you may maximize these resources to achieve your learning goals without taking on excessive debt.

Student loans in the US

2. Private student loans:

Private student loans can fill the gaps left by federal loans and scholarships, although taking a riskier approach. Compared to government-backed loans, private loans typically feature higher interest rates and fewer flexible repayment schedules. These involve taking out loans straight from banks or credit unions; the availability of a cosigner and your credit history are usually determining factors in loan approval.

Private loans can allow you to pay for expenses other than tuition and offer you greater borrowing freedom, but they often result in swiftly mounting debt that is impossible to repay. Market changes might affect variable interest rates, leading to unpredictable monthly payments. Moreover, compared to federal loans, there are fewer alternatives for repayment as well as deferment and forgiveness programs. Missed payments might damage your credit and make it harder for you to receive loans in the future.

Examine all federal assistance options before looking into private lending options. Carefully review your borrowing requirements and consider other choices, including grants, scholarships, and work-study. If private loans are needed, thoroughly review offers, being sure to pay attention to the cosigner requirements, interest rates, and terms of repayment. Keep in mind that getting a private loan entails a significant financial commitment, so borrowing wisely is crucial. Consider seeking advice from a qualified financial advisor to ensure you understand all the implications and can safely navigate the private lending landscape.

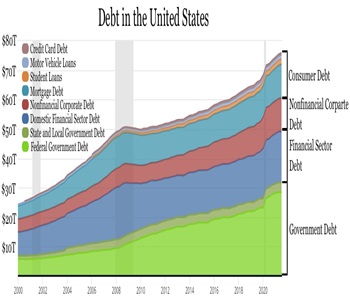

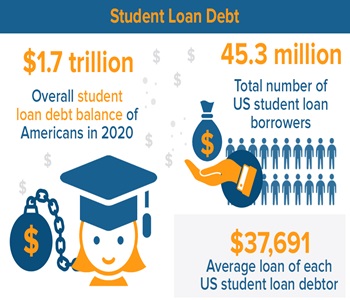

3. Student loan debt:

Student loan debt affects millions of Americans and has a big effect on their financial futures. More than 45 million borrowers owed more than $1.7 trillion in debt as of 2023. People are burdened by this mountain of debt, which raises doubts about their capacity to make ends meet and makes it impossible for them to save for important life events like homes or retirement.

The economic ramifications of this crisis are extensive and transcend individual hardships. Because a significant portion of their salary is used for loan repayments, young adults have less money that is available for other uses, which impacts the housing, automobile, and consumer goods industries. This limited purchasing power is a hindrance to overall economic growth. Furthermore, the burden falls disproportionately on underprivileged areas, exacerbating the income gap.

This problem needs to be solved in a variety of ways. Thought-provoking policies like income-driven repayment plans and improved financial literacy training may offer much-needed relief, but complete forgiveness schemes remain a divisive topic. We must concurrently address the root causes, such as rising college costs and declining scholarship funding, to prevent future generations from having to bear the same agonizing burden.

By acknowledging the gravity of student loan debt and implementing practical remedies, we can enable individuals and pave the way for a fairer and more prosperous tomorrow.

Student loans in the US

4. Impact of student loan debt:

People’s lives are impacted by student loan debt in many different ways, which can have an impact on anything from career choices to personal well-being. It goes beyond only financial difficulties. The weight of this debt may put constant strain on you, which could lead to:

- Life milestones delayed: Because of financial hardship, graduates usually have to put off major life objectives. As monthly expenses eat up available earnings, dreams of starting a family, buying a house, and even saving money for retirement recede. This rescheduled timetable could cause feelings of hopelessness and missed opportunities.

- Career compromises: In an attempt to control their debt, many graduates are forced to base their career decisions more on expected remuneration than on personal preference. The need to increase income may obstruct professional progress and lead to job dissatisfaction. Furthermore, employer-specific debt repayment programs may cause some people to feel trapped in their existing roles.

- Stress on the mind and emotions: Having to deal with debt daily can be emotionally and mentally exhausting. People who are bearing this burden often experience worry, depression, and hopelessness. These issues could create a vicious cycle by making pre-existing financial hardship worse.

- Economic stagnation: The impact of student loan debt extends beyond the borrowers themselves. When customers devote a significant portion of their income to repaying debt, their purchasing power decreases. This cutback stifles economic growth and undermines the economy of entire nations as well as individual cities.

- Increasing inequality: The burden of student loan debt falls disproportionately on marginalized groups, who have historically had less access to resources and scholarships. This perpetuates cycles of poverty and prevents upward mobility, exacerbating already-existing inequities.To solve this complex issue, a comprehensive plan is required. Individual options, like as income-driven repayment plans and debt forgiveness programs, can provide immediate help. However, long-term solutions must also address the root causes, such as rising tuition costs and a decline in the amount of available financial aid. We cannot ensure a future where education liberates people from enslavement unless we tackle both individual and institutional issues.

Student loans in the US

5. Policy debates:

Debt from student loans has become a complex and divisive policy issue in the United States. At its core lie two opposing perspectives: personal responsibility and collective action.

Personal responsibility proponents argue that debtors should be responsible for repaying their debts because they deliberately choose to take on debt. They emphasize the need for personal accountability and warn against moral hazard, which happens when forgiving discourages wise borrowing. Some of the recommended solutions include income-driven repayment plans, stricter loan eligibility standards, and increased emphasis on financial literacy education.

In response, proponents of collective action claim that the system is flawed. Rising tuition costs, stagnating salaries, and a lack of adequate financial help have led to an increasing proportion of people viewing debt as a necessity rather than a choice. They advocate for more comprehensive solutions, such as efforts to abolish tuition in higher education, more regulations on for-profit universities, and the forgiveness of some or all student loans. The objectives are to provide access to education without burdensome debt loads and to address social inequities.

The three primary grounds of disagreement in this argument are cost, justice, and effectiveness. Critics of broad forgiveness point out how expensive it is and express doubts about justice for people who have already made atonement or chosen to choose a different course of action. However, proponents assert that there are more benefits than drawbacks to having a population that is more financially secure and educated. Concerns about affordability and redressing injustices are also significant, with discussions focusing on helping those in greatest need.

It is up to us to work our way through this intricate web of policies and arrive at a resolution. In a comprehensive strategy, debt reduction programs might be paired with efforts to address the underlying causes, such as increased Pell Grant funding and increased college affordability. Achieving a balance between individual responsibility and collective efforts is the ultimate goal, ensuring that education generates opportunities rather than worsens financial hardships.